Certificates of Deposit (CDs) are a popular choice among risk-averse investors, particularly during times of high interest rates. The allure of a fixed rate of return, combined with FDIC insurance, makes CDs an attractive option for those seeking less risk and certainty in their investments. However, there are several reasons why investing in CDs at peak interest rates may not be the best financial strategy. Let’s explore the other side of the CD story.

Rate Decline After Peaks

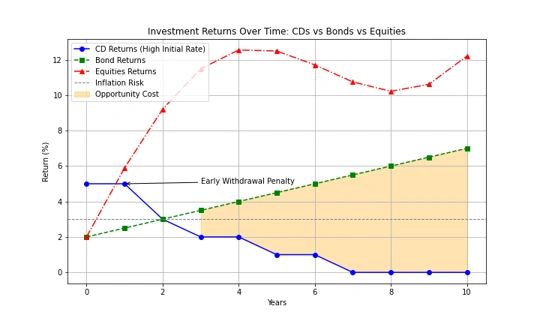

One of the key concerns with investing in CDs at peak interest rates is the historical tendency for these rates to decline significantly after peaking. Data shows that after CD rates reach their peak, they often drop sharply, which can substantially reduce the attractiveness of future returns. This decline means that the high rates available today might not be steady, and investors could find themselves with lower yields when they need to reinvest their matured CDs.

Underperformance Compared to Bonds

While CDs offer a fixed rate of return, they often underperform other fixed income investments such as bonds. Over both short and long-term periods, bonds, particularly short-term and municipal bonds, have historically provided better returns than CDs. For instance, a $100,000 investment in bonds can grow more significantly over one and five-year periods compared to the same amount invested in CDs. This underperformance can lead to missed opportunities for higher income and capital growth.

Lack of Capital Appreciation

CDs do not offer the potential for capital appreciation, meaning their value does not increase if interest rates fall. Unlike many bonds, which can rise in value as interest rates decline, CDs remain fixed. This lack of capital appreciation can be a disadvantage for investors looking to benefit from favorable market movements, limiting the overall growth potential of their portfolio.

Early Withdrawal Penalties

One of the drawbacks of CDs is the penalty for early withdrawal. If an investor needs access to their funds before the CD matures, they can face significant penalties that reduce their overall returns. This lack of liquidity can be a major disadvantage, especially in times of financial need or unexpected expenses, making CDs a less flexible investment option.

Reinvestment Risk

Reinvestment risk is another concern for CD investors, particularly in a fluctuating interest rate environment. Upon maturity, reinvesting in new CDs may offer lower rates if the interest rate environment has changed. This risk means that the attractive rates available today might not be available in the future, potentially resulting in lower returns over the long term.

Opportunity Cost

Holding money in CDs at peak rates can also result in significant opportunity costs. By locking funds into CDs, investors might miss out on potentially higher returns from other investment opportunities, such as equities or higher-yielding bonds. In a diversified investment strategy, it’s crucial to consider the potential growth and income from various asset classes, not just the safety of CDs.

Conclusion

While CDs offer the advantages of a fixed rate of return and FDIC insurance, there are several compelling reasons to reconsider investing in them at peak interest rates. The potential for declining rates, underperformance compared to bonds, lack of capital appreciation, early withdrawal penalties, reinvestment risk, and opportunity costs all present significant drawbacks. Investors should carefully weigh these factors and consider diversifying their portfolios to include a mix of asset classes that can offer better long-term growth and income potential. By doing so, they can pursue a more balanced and potentially more rewarding investment strategy.

Footnotes For Data Used In Graph

1. CD Returns: The data for CD returns is based on historical trends where CD rates tend to decline significantly after reaching their peak. The initial rate used is 5.2%, and the decline rate is modeled after historical averages. This simulation assumes an exponential decay after the first year

2. Bond Returns: Bond returns are modeled using a linear growth rate. The starting point of 2% is chosen as a conservative estimate for bond yields, with an additional 0.5% growth per year. This is a simplified representation based on typical performance of short-term and municipal bonds

3. Equities Returns: Equities returns are simulated with an initial rate of 2% plus a 1.5% annual growth rate and additional volatility modeled by a sine function. This represents the higher volatility and potential for greater returns characteristic of equity investments over time

4. Early Withdrawal Penalty: A the annotation for the early withdrawal penalty is included to highlight the risk associated with withdrawing funds from CDs before maturity. This penalty typically results in a loss of a few months interest, which is a significant consideration for investors needing liquidity.

5. Inflation Risk: The horizontal line at 3% represents a topical long-term average inflation rate. This is included to show that returns below this line would result in a loss of purchasing power over time, Data for inflation rates are sourced from historical averages reported by institutions like the Bureau of Labor Statistics

6. Opportunity Cost: The shaded area between CD returns and bond returns represents the opportunity cost of choosing CDs over bonds, this area illustrates the potential additional returns that could be earned by investing in bonds instead of CDs. Historical performance data of various fixed Income instruments like municipal and corporate bonds were considered to model this.

7. Source of Data:

CD Rates: Historical trends and averages derived from FDIC data and financial market analyses.

Bond Yields: Typical performance data for short-term and municipal bonds from sources such as the Federal Reserve and bond market indices

Equities Performance: Based on historical market data and average returns reported by major stock market indices like the S&P 500.

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.

CDs are FDIC insured to specific limits and offer a fixed rate of return if held to maturity, whereas investing in securities is subject to market risk including loss of principal.